All across the country, child care is one of the highest costs in a family’s budget. Many families find themselves in need of help paying for child care or finding affordable options that meet their needs.

Child care costs vary based on where you live, the type of child care you use, your schedule of care, and your child’s age. When you receive a child care referral list from Child Care Aware of Virginia, you will see a table with average care costs in your area. This can give you an idea of how much you might expect to pay, based on the type of care and age group. There may also be other child care costs in addition to the weekly or monthly tuition costs. Many programs charge an annual registration fee, and some may also charge fees for materials, uniforms, field trips, meals, and snacks. When speaking with providers, make sure you ask about any additional fees they may charge.

If you find yourself in need of assistance paying for child care, there are programs and resources available to you.

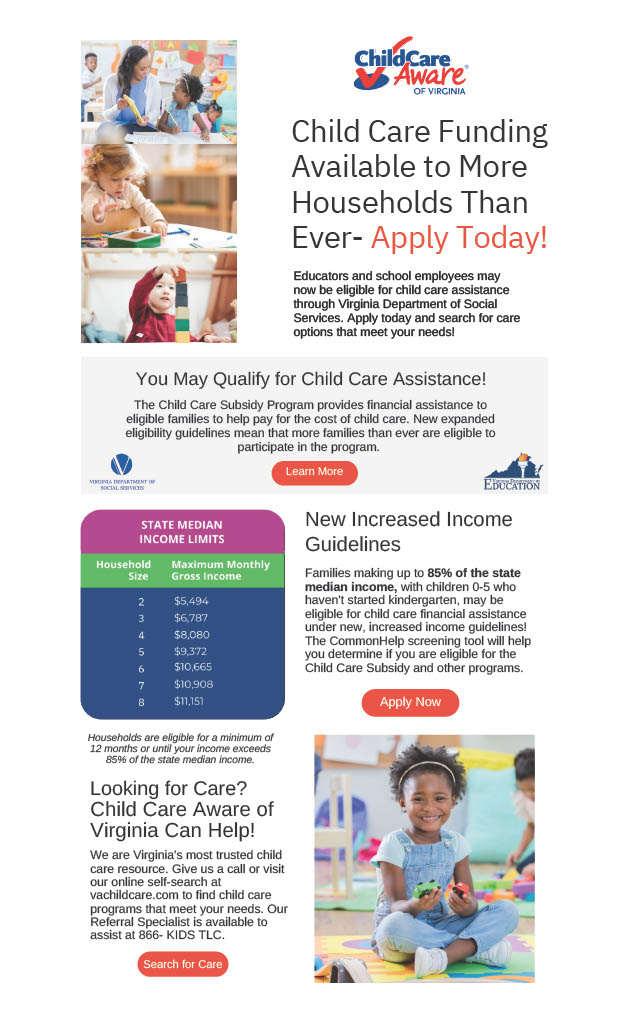

VA Child Care Subsidy Program

The VA Child Care Subsidy Program provides financial assistance to eligible families to help pay for the cost of child care so they can work or attend education or training pro-grams. Families with children aged 0– 5 may be eligible for financial assistance under new, increased income guidelines. Learn more at www.childcare.virginia.gov.

Early Head Start/Head Start

Early Head Start serves children from birth to 2 years old, and Head Start serves children ages 3—5. These programs provide a wide range of services to support children’s development and work with families to support their children.

Both programs are federally funded and are available in every state, territory, and tribal community. Families with incomes at or below the poverty level may be eligible. Special consideration is given to children who have disabilities, children in foster care, families experiencing homelessness, and families receiving certain types of public assistance. To find out if your family is eligible, contact your nearest Head Start Program.

State-Funded Pre-K

Virginia public schools operate certified preschool programs, and the state also certifies programs operated by accredited private schools. Virginia is working to improve quality and expand access to preschool programs for at-risk, low-income, and specials needs children. Ask our Referral Specialist for help finding a Pre-K program near you.

Military and DoD Fee Assistance Programs

The Department of Defense pairs with the national organization—Child Care Aware of America– to offer military fee assistance to eligible members of the military and DoD when the on-base care option is full. Eligibility requirements vary and are determined by each branch of service or agency.

Please note: Child Care Aware of Virginia is not not responsible for the military fee assistance program. Please visit Child Care Aware of America or call 1-800-424-2246 for more information.

Local Programs

Local government, United Way agencies, and other community or faith-based organizations sometimes provide child care scholarships or fee assistance. Look up your county’s assistance programs or reach out to our Referral Specialist for help.

Ask your employer or school if these options exist to help you with child care costs:

Dependent Care Flexible Spending Account (FSA)

Some employers have plans that allow employees to reserve a portion of their wages for child care. Money from each paycheck is taken out pre-tax and placed into a special fund that can only be used for child care costs. Talk to your Human Resources department to find out if this is an option where you work.

Employer/School Support

Your employer may offer child care scholarships, discounts to certain child care programs, or on-site child care at reduced rates. Some colleges and universities also have on-site child care programs to help with costs. Ask your Human Resources department or college office if they have relationships with local child care providers or offer other options.

Ask the providers on your referral list if they offer:

Sliding Fee Scales

Some providers allow families to pay a rate based on their income. This is called a sliding fee scale. If the provider does not offer a sliding fee scale, you can also ask if they offer payment plans or other options to help pay for care.

Scholarships

Some local non-profit organizations and individual child care providers may offer fee assistance or scholarships. Look for non-profit organizations servicing your county/community or ask the provider if they offer scholarships.

Negotiable Rates

Due to your specific needs, child care providers may also be willing to negotiate their child care rates. Don’t be afraid to ask – they might be able to work something out to make it work for your family.

Discounts

Many child care programs offer discounts to families, such as sibling discounts, military discounts, first responder discounts, etc. They may take off a percentage or dollar amount of a child’s weekly or monthly rate. They may also waive the registration fee or other fees.

Tax Credits

While tax credits can only be accessed after filing your taxes, you may be able to use your tax refund to put toward child care costs. You may be eligible to claim credits such as the Child Tax Credit the Child and Dependent Care Tax Credit, and the Earned Income Tax Credit. These credits and others may help you to receive a tax refund.

If your family is ineligible for child care assistance or if you find that child care costs are still out of your reach, consider other possibilities or changes:

- Is it possible or desirable to work fewer hours?

- If you are in a two-parent household, can you work at different times and share some hours of child care?

- Could you share child care expenses with another family?

- Are there other types of care you haven’t considered, such as Family Day Homes or faith-based providers?

Our friends at Child Care Aware of America have compiled some very helpful resources to help you budget for child care expenses. Visit them HERE .